AT&T, one of the largest telecommunications companies in the United States, has recently undergone significant organizational changes that include a notable reduction in workforce. This has garnered considerable attention from industry watchers, employees, and stakeholders. The reduction in force (RIF) is part of a broader strategy AT&T is implementing to streamline operations, cut costs, and pivot towards its core business priorities in an ever-changing technological landscape.

Contents of Post

TL;DR – Summary of the AT&T Layoffs

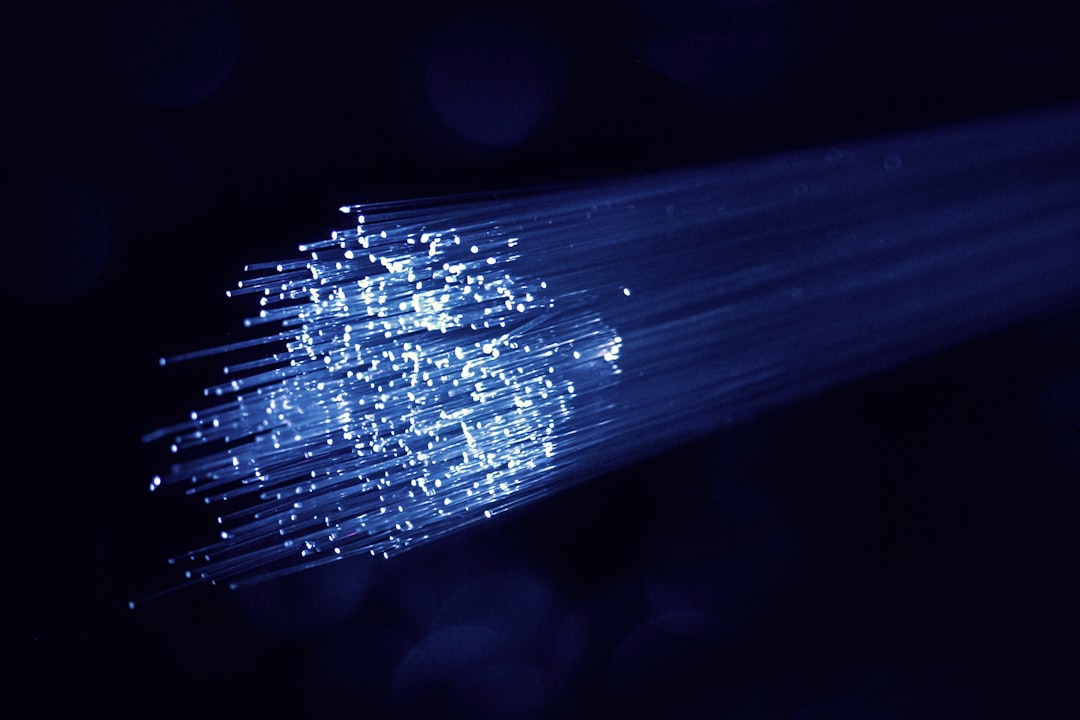

In the past year, AT&T has implemented substantial layoffs affecting thousands of workers across various departments. The workforce reduction aligns with the company’s shift to focus more heavily on its 5G and fiber internet businesses, moving away from older legacy operations. Financial pressures and the need for operational efficiency are key drivers of this move. While the layoffs raise concerns about job stability and morale, AT&T insists they are essential to staying competitive in a rapidly evolving market.

Background and Context

AT&T has been undergoing a strategic transformation for several years, especially following its divestiture of WarnerMedia and its commitment to simplifying its business structure. Its current focus on expanding fiber and 5G services across the U.S. comes with substantial capital requirements and the necessity to reduce overhead. Workforce adjustments, though painful, are part of this economic recalibration.

In 2023 and leading into 2024, AT&T confirmed job cuts that, according to some reports, could reach up to over 10,000 positions over several quarters. These layoffs span multiple areas, including customer service, technical operations, and corporate management. The company has stated that it aims to create a more agile and performance-driven workforce better aligned with its long-term goals.

Scope and Distribution of the Layoffs

Though exact figures have not been consistently confirmed, data from multiple employee forums, regulatory filings, and insider sources point to job reductions occurring across several U.S. cities and regions. Unionized and non-unionized employees have both been affected, although specifics vary by local agreements and roles.

Key areas impacted by the layoffs include:

- Call Centers: Several call centers in states such as California, Texas, and Georgia have seen staffing reductions or complete closures. This reflects a shift toward AI-based customer support and self-service portals.

- Field Technicians: With a move away from legacy DSL services and copper lines, the need for certain technical roles is diminishing. AT&T is reallocating resources to fiber deployment instead.

- Corporate Administrations: Reductions in middle management and support roles are part of efforts to flatten the organizational structure and speed up decision-making processes.

Furthermore, AT&T has begun outsourcing more roles to partners both within and outside the U.S., especially those related to IT support, payroll processing, and HR functions.

Reasons Behind the Reduction in Force

AT&T has publicly stated that the layoffs are not merely a cost-cutting measure but are a strategic move to align its capacity with emerging business needs. Several contributing factors include:

- Shifting Business Priorities: The company is doubling down on its 5G wireless networks and its nationwide fiber internet expansion. Legacy operations like copper-based services and satellite television are in decline.

- Financial Pressure: High capital expenditures for network improvements, along with mounting debt from previous acquisitions, have compelled management to evaluate all areas of spending, including payroll.

- Technological Automation: Automation and digitization are transforming how telecom services are delivered. Tasks once performed by humans are increasingly being handled by software, AI, and machine learning algorithms.

Employee Reactions and Union Responses

AT&T’s employee base is diverse, and responses to the RIF have been mixed. Layoffs always breed anxiety, and those affected have shared experiences of abrupt changes, limited severance packages, and a feeling of uncertainty in employee forums and social media platforms. Some long-time employees report being let go after decades of service.

Unions such as the Communications Workers of America (CWA) have expressed concern not only for those laid off but also for the remaining workforce now facing increased workloads and fewer resources. The CWA has called for better severance terms, more transparent communication from leadership, and retraining opportunities for displaced workers.

In a statement, the union noted:

“We are deeply disappointed with AT&T’s continued layoffs, especially as the company continues to report multi-billion-dollar quarterly profits. The workers who built this network deserve better.”

Investor and Market Perspective

From Wall Street’s point of view, the layoffs have been met with cautious optimism. Many analysts argue that while RIFs are painful in the short term, they may be necessary for AT&T to remain competitive in a tightening telecom market.

Following the announcements of job cuts, AT&T’s stock saw modest increases, suggesting that investors viewed the austerity measures favorably. Analysts have credited CEO John Stankey’s leadership with making difficult, but necessary, choices to position AT&T for long-term success.

Key points for investors include:

- Operational Efficiency: Lower labor costs are likely to improve short- to mid-term profit margins.

- Increased Capital for Growth: Reducing recurring payroll expenses allows for more investment in lucrative areas such as broadband expansion and network modernization.

- Risk of Reputational Impact: While layoffs can stabilize finances, they can also erode employee morale and brand reputation if not handled delicately.

Comparisons with Industry Trends

AT&T is not alone in its workforce reduction strategy. Other telecommunications giants like Verizon and T-Mobile have also undergone periodic layoffs, though not always on the same scale or with the same level of publicity.

The telecom industry is facing a dual challenge of high capital expenses and increasing competition from non-traditional players like Google Fiber, Starlink, and private 5G network providers. As a result, job realignments are becoming commonplace to maintain competitiveness and shareholder returns.

Future Outlook

AT&T executives maintain that the RIFs are part of a larger blueprint that will lead to a stronger, more agile company in the coming years. With projected investments of over $20 billion in its broadband and 5G initiatives, leadership believes the current sacrifices will yield better customer satisfaction and growth potential.

However, much will depend on market execution and public perception. To emerge positively from this transitional period, AT&T will need to:

- Continue enhancing retraining and upskilling programs for current employees

- Maintain transparent communication about future organizational changes

- Create new roles, especially in tech-focused departments, to offset long-term job losses

Furthermore, public and political scrutiny of large-scale layoffs, particularly from profitable corporations, remains high. How AT&T handles stakeholder engagement in the fallout of these reductions could shape its narrative for years to come.

Conclusion

The recent AT&T reduction in force is symptomatic of broader changes underway in the telecommunications industry. While layoffs have caused understandable concern among employees and their families, AT&T argues that such actions are vital in pursuing technological innovation, operational efficiency, and market leadership. Whether the strategy pays off will unfold in the coming quarters, but one thing is clear: the landscape of telecom employment is evolving, and companies and workers alike must adapt.